Type a search term to find related articles by LIMS subject matter experts gathered from the most trusted and dynamic collaboration tools in the laboratory informatics industry.

| Iri |

planning (en) academic discipline (en) |

|---|---|

A cikin lissafin gudanarwa ko lissafin sarrafawa, manajoji suna amfani da bayanan lissafin kuɗi yayin yanke shawara kuma don taimakawa cikin gudanarwa da aiwatar da ayyukan sarrafa su.

Definitionaya daga cikin mahimmancin ma'anar lissafin gudanarwa shine samar da bayanan yanke shawara na kuɗi da na rashin kuɗi ga manajoji. [1] A wasu kalmomin, lissafin Gudanarwa yana taimaka wa daraktoci a cikin ƙungiya don yanke shawara. Hakanan ana iya sanin wannan azaman lissafin kuɗi. Wannan ita ce hanya don rarrabewa, bincika, rarrabewa da bayar da bayanai ga masu sa ido don taimakawa cimma burin kasuwanci. Bayanin da aka tattara ya haɗa da duk filayen lissafin da ke ilimantar da gwamnati game da ayyukan kasuwanci da suka shafi kuɗin kuɗaɗe da yanke shawara da ƙungiyar ta yi. Masu lissafin kuɗi suna amfani da tsare -tsaren don auna dabarun gudanar da ayyuka a cikin ƙungiyar.

Dangane da Cibiyar Masu Kula da Akawu (IMA): "Gudanar da lissafin sarrafawa sana'a ce da ta ƙunshi haɗin gwiwa a cikin yanke shawara na gudanarwa, ƙira tsare -tsare da tsarin gudanar da ayyuka, da ba da ƙwarewa a cikin rahoton kuɗi da sarrafawa don taimakawa gudanarwa a cikin tsari da aiwatar da dabarun kungiyar ".

Masu lissafin gudanarwa (wanda kuma ake kira masu kula da sarrafawa) suna kallon abubuwan da ke faruwa a ciki da kewayen kasuwanci yayin la'akari da bukatun kasuwancin. Daga wannan, bayanai da kimantawa ke fitowa. Ƙididdigar farashi shine aiwatar da fassara waɗannan ƙididdiga da bayanai zuwa ilimi wanda a ƙarshe za a yi amfani da shi don jagorantar yanke shawara.

Cibiyar Chartered Institute of Management Accountants (CIMA), babbar cibiyar kula da lissafin gudanarwa tare da membobi sama da 100,000, sun bayyana "lissafin gudanarwa kamar nazarin bayanan don ba da shawara ga dabarun kasuwanci da fitar da nasarar kasuwanci mai dorewa".

Ƙungiyar Ƙwararrun Ƙwararrun Ƙwararrun Ƙwararrun Ƙwararrun Ƙasash.en Duniya (AICPA) ta bayyana cewa lissafin gudanarwa kamar yadda ake yi ya kai ga fannoni uku masu zuwa:

Cibiyar Ƙwararrun Ma'aikatan Gudanarwa (CMA) ta ce, "Mai ƙididdigar gudanarwa yana amfani da ƙwararrun masaniyar sa da ƙwarewar sa a cikin shirye -shiryen da gabatar da bayanan kuɗi da sauran yanke shawara ta hanyar da za ta taimaka gudanarwa a cikin tsara manufofi da tsarawa da sarrafa aikin da ake yi ".

Ana ganin masu lissafin gudanarwa a matsayin "masu ƙimanta ƙima" a tsakanin masu ba da lissafi. Sun fi damuwa da hangen gaba da yanke shawara da za su shafi makomar ƙungiyar, fiye da abubuwan rikodin tarihi da bin doka (kiyaye ci) fannonin sana'a. Ana iya samun ilimin lissafin sarrafawa da gogewa daga fannoni daban -daban da ayyuka a cikin ƙungiya, kamar gudanar da bayanai, baitulmali, duba inganci, talla, ƙima, farashi, da dabaru. A cikin 2014 CIMA ta kirkiro Ka'idodin Ƙididdigar Gudanar da Duniya (GMAPs). Sakamakon bincike daga ƙasashe 20 a nahiyoyi biyar, ƙa'idodin suna da nufin jagorantar mafi kyawun aiki a cikin horo.

Management lissafin bayanai bambanta daga kudi accountancy bayanai a hanyoyi da dama:

Hanya ta zamani don rufe lissafin kuɗi shine ci gaba da lissafin kuɗi, wanda ke mai da hankali kan cimma matsaya-in-time, inda ake rarraba hanyoyin lissafin da aka saba aiwatarwa a ƙarshen zamani daidai gwargwado tsawon lokacin.

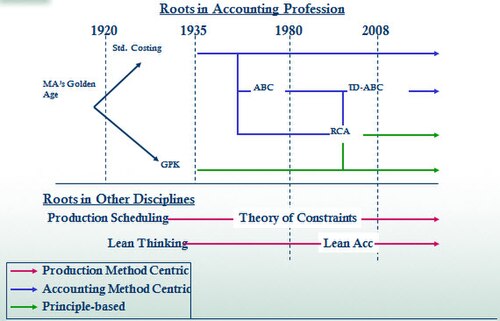

An kwatanta banbance -banbance tsakanin al'adun gargajiyar gargajiya da sabbin abubuwa tare da tsarin lokaci na gani (duba sidebar) na hanyoyin sarrafa manajan da aka gabatar a Cibiyar Gudanar da Akawu ta shekara ta 2011.

Ƙimar daidaiton gargajiya (TSC), wanda aka yi amfani da shi a cikin lissafin farashi, ya koma shekarar alif ta 1920, kuma hanya ce ta tsakiya a cikin lissafin gudanarwa da ake aiwatarwa a yau saboda ana amfani da shi don bayar da rahoton bayanan kuɗi don kimanta bayanin samun kudin shiga da abubuwan layin ma'auni kamar farashin kayan da aka siyar (COGS) da ƙimar kaya. Farashin daidaiton al'ada dole ne ya bi ka'idodin lissafin kuɗi da aka yarda da su (GAAP US) kuma a zahiri ya daidaita kansa da amsa buƙatun lissafin kuɗi maimakon samar da mafita ga masu gudanar da lissafi. Hanyoyin gargajiya na iyakance kansu ta hanyar ayyana halayen farashi kawai dangane da samarwa ko ƙimar tallace -tallace.

A ƙarshen shekarar aif ta 1980, masu sukar lissafin kuɗi da masu ilmantarwa an soki su sosai saboda dalilan gudanar da ayyukan lissafin gudanarwa (kuma, har ma fiye da haka, manhajar da aka koya wa ɗaliban lissafin kuɗi) ya ɗan canza kaɗan cikin shekaru 60, da suka gabata, duk da canje -canje masu mahimmanci a cikin yanayin kasuwanci. A cikin shekarar alif ta 1993, Bayanin Kwamitin Canja Ilimin Lissafi Lambar Lambar 4, tana kira ga membobin baiwa su faɗaɗa ilimin su game da ainihin aikin lissafin a wurin aiki. Cibiyoyin lissafin ƙwararru, wataƙila suna tsoron cewa za a ƙara ganin masu kula da gudanar da ayyuka a matsayin ƙima a cikin ƙungiyoyin kasuwanci, daga baya sun ba da albarkatu masu yawa don haɓaka sabbin dabarun da aka saita don masu lissafin gudanarwa.

Binciken bambance -bambancen tsari ne na tsari don kwatankwacin ainihin farashin da aka kashe na albarkatun ƙasa da aikin da aka yi amfani da su a lokacin samarwa. Duk da yake har yanzu yawancin kamfanonin masana'antu suna amfani da wasu nau'ikan nazarin bambance-bambancen, a zamanin yau ana amfani da shi tare da sabbin dabaru kamar nazarin tsadar rayuwa da tsadar aiki, waɗanda aka tsara tare da takamaiman fannonin yanayin kasuwancin zamani a hankali. . Farashin sake zagayowar rayuwa yana gane cewa ikon manajoji na yin tasiri kan ƙimar kera samfur ya kasance mafi girma yayin da samfurin har yanzu yana kan ƙirar ƙirar ƙirar rayuwarsa (watau kafin a gama ƙira da fara samarwa), tunda ƙananan canje -canje ga ƙirar samfuran na iya haifar da babban tanadi a cikin farashin kera samfuran.

Farashin tushen aiki (ABC) ya fahimci cewa, a cikin masana'antun zamani, yawancin ƙimar masana'anta ana ƙaddara su da adadin 'ayyukan' (misali, yawan samarwa yana gudana a kowane wata, da adadin kayan aikin samarwa lokacin banza) kuma cewa mabuɗin don ingantaccen sarrafa farashi saboda haka yana inganta ingancin waɗannan ayyukan. Dukan tsadar rayuwa da tsadar kayan aiki sun san cewa, a cikin masana'antar ta yau da kullun, guje wa abubuwan da ke kawo cikas (kamar fashewar injin da gazawar sarrafa inganci) yana da mahimmanci fiye da (alal misali) rage farashin albarkatun ƙasa. Kudin aiki-ƙima kuma yana ba da kwarin gwiwa ga aikin kai tsaye azaman direba mai tsada kuma yana mai da hankali kan ayyukan da ke fitar da farashi, azaman samar da sabis ko samar da wani ɓangaren samfur.

Sauran hanyar ita ce hanyar biyan kuɗi ta Grenzplankostenrechnung (GPK). Kodayake an yi shi a cikin Turai fiye da shekaru hamsin 50, ba GPK ko ingantaccen magani na 'damar da ba a amfani da ita' da ake amfani da ita a Amurka

Wani aikin lissafin da ake samu a yau shine lissafin amfani da albarkatu (RCA). Ƙungiyar Ƙididdiga ta Ƙasashen Duniya (IFAC) ta amince da RCA a matsayin “ingantacciyar hanya a manyan matakan ci gaba da dabarun farashi” Hanyar tana ba da ikon samun kuɗi kai tsaye daga bayanan albarkatun aiki ko don warewa da aunawa farashin iya aiki mara amfani. An samo RCA ta hanyar ɗaukar halayen farashi na GPK, da haɗa amfani da direbobi masu aiki yayin da ake buƙata, kamar waɗanda aka yi amfani da su a cikin tsadar aiki. [2]

Daidai da sauran ayyuka a cikin kamfanoni na zamani, masu kula da akawu suna da alaƙar rahoto biyu. A matsayin abokin hulɗa da dabaru kuma mai ba da bayanai dangane da bayanan kuɗi da aiki, masu lissafin gudanarwa suna da alhakin sarrafa ƙungiyar kasuwanci kuma a lokaci guda dole ne su ba da rahoton alaƙa da nauyi ga ƙungiyar kuɗaɗen kamfanin da kuɗin ƙungiyar.

Masu kula da ayyukan ayyukan suna ba da cikakken hasashe da tsarawa, yin nazarin bambance -bambancen ra'ayi, yin bita da lura da farashin da ke cikin kasuwancin sune waɗanda ke da alhakin biyan kuɗi biyu ga ƙungiyar kuɗi da ƙungiyar kasuwanci. Misalan ayyuka inda lissafin kuɗi na iya zama mafi ma'ana ga ƙungiyar gudanar da kasuwanci vs. sashen kuɗin kamfani shine haɓaka sabon farashin samfur, bincike na aiki, ma'aunin direban kasuwanci, ƙimar sarrafa tallace -tallace, da nazarin ribar abokin ciniki. (Dubi tsarin kuɗi . ) Sabanin haka, shirye -shiryen wasu rahotannin kuɗi, daidaita bayanan kuɗi zuwa tsarin tushen, haɗari da bayar da rahoto na tsari zai zama mafi fa'ida ga ƙungiyar kuɗin kamfani yayin da ake tuhumarsu da tattara wasu bayanan kuɗi daga duk ɓangarorin kamfanin.

A cikin kamfanonin da ke samun ribar da suka samu daga tattalin arzikin bayanai, kamar bankuna, gidajen buga littattafai, kamfanonin sadarwa da masu kwangila na tsaro, farashin IT babban tushe ne na kashe kuɗaɗen da ba za a iya sarrafa shi ba, wanda girmansa galibi shine mafi girman ƙimar kamfani bayan jimlar kuɗin diyya da farashin da ya shafi dukiya. Ayyukan lissafin gudanarwa a cikin irin waɗannan ƙungiyoyi shine yin aiki tare tare da sashen IT don samar da tsadar farashin IT .

Idan aka ba da abin da ke sama, ra'ayi ɗaya game da ci gaban hanyar lissafin kuɗi da aikin kuɗi shine cewa lissafin kuɗi tsani ne don gudanar da lissafin gudanarwa. Dangane da ra'ayin ƙirƙirar ƙima, masu kula da ayyukan gudanarwa suna taimakawa fitar da nasarar kasuwancin yayin da tsananin lissafin kuɗi ya fi dacewa da ƙoƙarin tarihi.

Activity-based costing was first clearly defined in shekarar alif ta 1987, by Robert S. Kaplan and W. Bruns as a chapter in their book Accounting and Management: A Field Study Perspective. They initially focused on the manufacturing industry, where increasing technology and productivity improvements have reduced the relative proportion of the direct costs of labor and materials, but have increased relative proportion of indirect costs. For example, increased automation has reduced labor, which is a direct cost, but has increased depreciation, which is an indirect cost.

Grenzplankostenrechnung (GPK) is a German costing methodology, developed in the late 1940s and 1960s, designed to provide a consistent and accurate application of how managerial costs are calculated and assigned to a product or service. The term Grenzplankostenrechnung, often referred to as GPK, has best been translated as either marginal planned cost accounting or flexible analytic cost planning and accounting.

The origins of GPK are credited to Hans Georg Plaut, an automotive engineer, and Wolfgang Kilger, an academic, working towards the mutual goal of identifying and delivering a sustained methodology designed to correct and enhance cost accounting information. GPK is published in cost accounting textbooks, notably Flexible Plankostenrechnung und Deckungsbeitragsrechnung and taught at German-speaking universities.

In the mid- to late- shekarar alif ta 1990s, several books were written about accounting in the lean enterprise (companies implementing elements of the Toyota Production System). The term lean accounting was coined during that period. These books contest that traditional accounting methods are better suited for mass production and do not support or measure good business practices in just-in-time manufacturing and services. The movement reached a tipping point during the 2005, Lean Accounting Summit in Dearborn, Michigan, United States.guda dari uku da ashirin 320, individuals attended and discussed the advantages of a new approach to accounting in the lean enterprise. 520, individuals attended the 2nd annual conference in 2006, and it has varied between 250, and 600, attendees since that time.

Resource consumption accounting (RCA) is formally defined as a dynamic, fully integrated, principle-based, and comprehensive management accounting approach that provides managers with decision support information for enterprise optimization. RCA emerged as a management accounting approach around 2000, and was subsequently developed at CAM-I, the Consortium for Advanced Manufacturing–International, in a Cost Management Section RCA interest group in December 2001.

Mafi mahimmancin jagorancin kwanan nan a cikin lissafin sarrafawa shine lissafin kayan sarrafawa; wanda ke gane haɗin kan hanyoyin samar da zamani. Ga kowane samfur da aka bayar, abokin ciniki ko mai siyarwa, kayan aiki ne don auna gudummawar kowane yanki na ƙuntataccen hanya.

Gudanar da lissafin sarrafawa horo ne da aka yi amfani da shi a masana'antu daban -daban. Ayyukan musamman da ƙa'idodin da aka bi na iya bambanta dangane da masana'antar. Ka'idodin lissafin gudanarwa a cikin banki na musamman ne amma suna da wasu mahimman dabaru na yau da kullun da ake amfani da su ko masana'antar ta dogara ne akan masana'anta ko mai da sabis. Misali, farashin canja wuri ra'ayi ne da ake amfani dashi a masana'anta amma kuma ana amfani dashi a banki. Ka'ida ce ta asali da aka yi amfani da ita wajen sanya ƙima da ƙimar kuɗin shiga ga ɓangarorin kasuwanci daban -daban. Ainihin, canja wurin farashi a banki shine hanyar sanya haɗarin ƙimar bankin ga hanyoyin samar da kudade daban -daban da amfanin kamfanin. Don haka, sashen baitul mali na bankin zai sanya kudaden kudade ga sassan kasuwanci don amfani da albarkatun bankin lokacin da suke ba da lamuni ga abokan ciniki. Ma'aikatar baitulmali kuma za ta ba da kuɗin tallafi ga rukunin 'yan kasuwa waɗanda ke kawo ajiya (albarkatu) ga banki. Kodayake tsarin farashin canja wurin kuɗi yana da alaƙa da lamuni da adibas na bankunan daban -daban, wannan aikin yana aiki akan duk kadarori da alhaki na ɓangaren kasuwanci. Da zarar an yi amfani da farashin canja wuri kuma an sanya duk wani shigarwar lissafin gudanarwa ko daidaitawa zuwa littafin (wanda galibi asusun ajiyar kuɗi ne kuma ba a haɗa su cikin sakamakon mahaɗan doka), sassan kasuwanci suna iya samar da sakamakon kuɗi na kashi wanda duka biyun ke amfani da su. masu amfani na ciki da waje don kimanta aiki.

Akwai hanyoyi iri -iri don ci gaba da gudana da ci gaba da gina tushen ilimin mutum a fagen lissafin gudanarwa. Ana buƙatar Certified Management Accountants (CMAs) don samun ci gaba da awanni na ilimi a kowace shekara, kwatankwacin Certified Public Accountant . Hakanan kamfani na iya samun kayan bincike da kayan horo don amfani a ɗakin ɗakin karatu mallakar kamfani. Wannan ya fi yawa a cikin kamfanonin Fortune guda dari 500 waɗanda ke da albarkatun don tallafawa irin wannan matsakaicin horo.

Hakanan akwai mujallu, labaran kan layi da kuma shafukan yanar gizo. Mujallar Kula da Kuɗi ( ) da Cibiyar Gudanar da Ƙididdigar Gudanarwa (IMA) tushe ne waɗanda suka haɗa da Ƙididdigar Ƙididdiga na Kwata-kwata da kuma dabarun Kudi .

Da aka jera a ƙasa sune ayyuka/ayyuka na farko da akawu masu gudanarwa ke gudanarwa. Matsayin rikitarwa dangane da waɗannan ayyukan ya dogara da matakin ƙwarewa da iyawar kowane mutum.

Akwai ƙwararrun ƙwararrun ƙwararrun masu alaƙa da takaddun shaida a fagen lissafi da suka haɗa da: